But a credit rating is essential for more than just financing buys — you might be needed to have a superb credit rating to land an apartment, get a superb insurance policy rate and sometimes it might make having onto a utility account less complicated.

Speak with your lender about what timelines they provide to lock in a rate as some should have different deadlines. An interest rate lock agreement will contain: the rate, the kind of loan (for instance a thirty-yr, preset-rate mortgage), the date the lock will expire and any details you might be spending towards the loan. The lender may show you these terms more than the mobile phone, but it’s smart to get it in crafting too.

We don't offer monetary information, advisory or brokerage solutions, nor can we advise or recommend individuals or to purchase or market certain shares or securities. Functionality information can have transformed Because the time of publication. Earlier effectiveness just isn't indicative of long run outcomes.

For borrowers with credit scores inside the "negative" or "weak" variety—among 300 and 579—locating a loan is tough. Loans These borrowers do uncover ordinarily include APRs within the significant double- or triple-digits.

Credit-builder lenders normally have to have the identical paperwork desired for a personal loan. The necessities may differ among lenders but normally incorporate:

In its place, you must study unexpected emergency loan choices and possibilities. While More help an crisis loan is often a simple Option when you qualify, they can even be costly — nonprofits and negotiation may well help you save you some dollars and aid you through.

reimbursement to yourself for revenue expended before requesting the loan, such as “earnest dollars” or possibly a deposit in your deposit

What's an Interest Rate? The interest rate is the quantity a lender costs a borrower which is a proportion on the principal—the quantity loaned. The interest rate on a loan is typically observed on an once-a-year foundation and expressed being an yearly share rate (APR).

Federal Reserve financial coverage. Mortgage rates are indirectly influenced through the Federal Reserve’s monetary plan. When the central financial institution raises the federal cash concentrate on rate, because it did in the course of 2022 and 2023, which has a knock-on influence by producing quick-term interest rates to go up.

APRs and costs. Your regular monthly payment might not deal with interest and payment expenses. In such situations, These expenses are deducted after you’ve produced your entire scheduled payments, which often can have a huge chunk out from the money you receive.

Your loan in nonpay status Learn here If we're notified that you've absent into approved nonpay standing When you have An impressive TSP loan, your loan payments will be suspended.

When it’s not certain regardless of whether a rate will go up or down amongst weeks, it may in some cases take numerous weeks to months to close your loan.

For those who’re in the marketplace for a different property and mortgage rates begin to minimize, take into consideration locking within your rate. This makes certain your interest rate gained’t transform amongst the supply and closing.

Jordan Tarver has spent 7 several years covering mortgage, own loan and business enterprise loan information for foremost economic publications for example Forbes Advisor. He blends knowledge from his bachelor's degree in organization finance, his knowledge like a top performer from the mortgage market and his entrepreneurial achievement to simplify complex money subjects. Jordan aims to create mortgages and loans comprehensible.

Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Catherine Bach Then & Now!

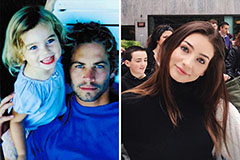

Catherine Bach Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!